Live on Long Island? 9 Things You Should Know About The New Tax Plan

Biden tax plan and real estate:

"You would pay capital gains on that $300,000 increase in property value at a 20% tax rate. But under Biden's tax plan, individual long-term gains would increase from a 20% rate to a maximum rate of 39.6% on ordinary income. The new top rate would apply only to people earning over $1 million per year." - Forbes

Council Post: How Biden's Tax Proposals Could Impact Real Estate Investors

Here is what real estate investors need to be thinking about in regards to their taxes. ...

"The capital gains tax is due when you sell your investment. For example, if your home appreciates in value, you will not owe a capital gains tax during the years that you own it." - Reuters

Fact check: Biden will only tax capital gains at 40% for those earning over $1 million annually

Shared thousands of times on Facebook with less than a month until the Nov. 3 general elec...

Below Blog Written January 2018

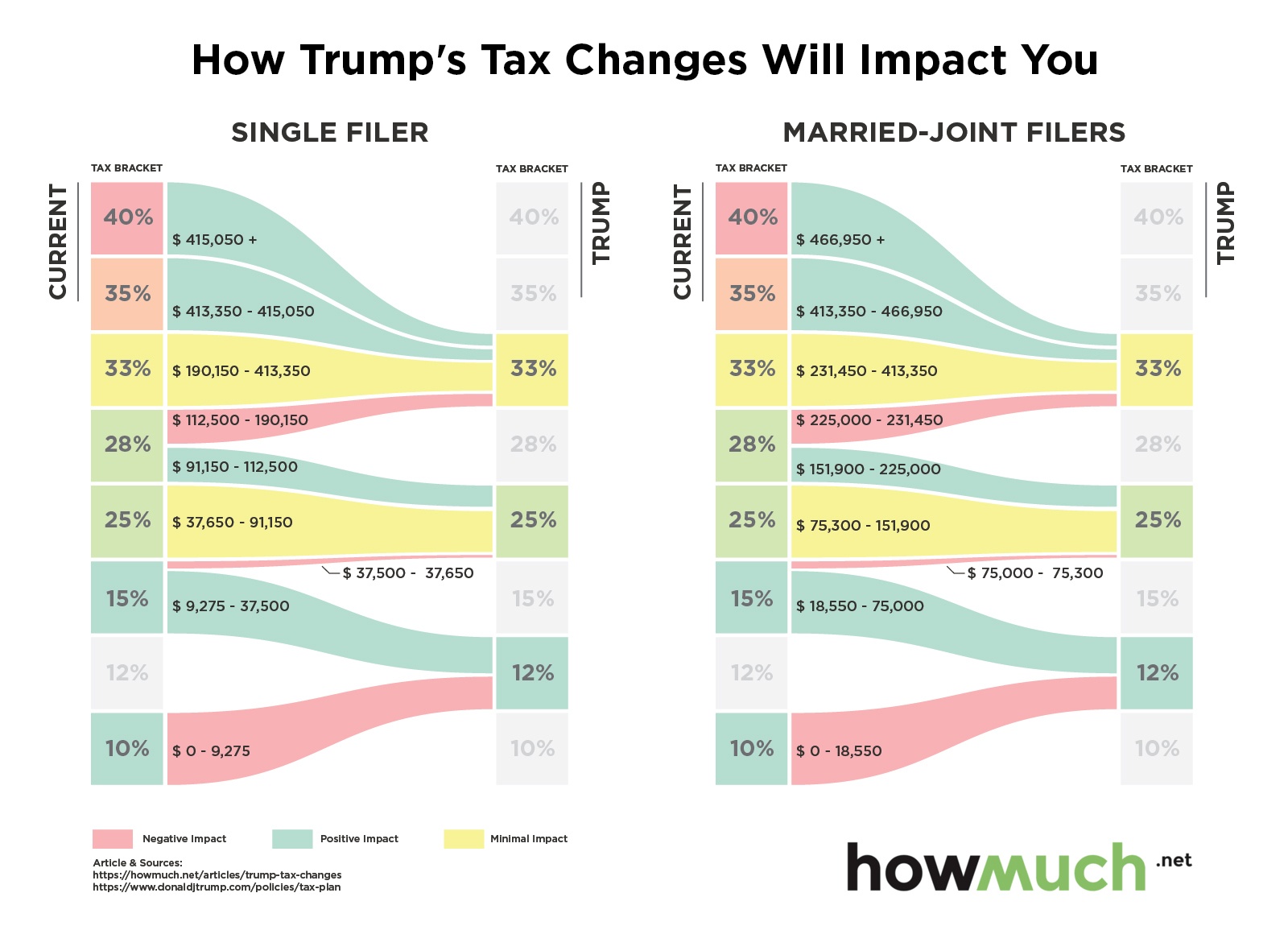

The Tax Reform bill that recently passed has many different implications for Long Islanders. Real Estate Industry leaders and groups including NAR (National Association of Realtors), LIBOR/LIRealtor (Long Island Board of Realtors), Zillow and others have had a lot to say. Here are some of the take aways and links to read more.

- "State and local tax deductions. Both property taxes and state and local incomes taxes remain deductible, although with a combines limit of $10,000." - LI Realtor

- "Mortgage Interest. No change for homeowner with existing mortgages, and allows for deductions for interest up to $750,000 on a new home mortgage." - Newsday

- "Under this plan, the property owner will be unable to deduct income tax payments and will most likely see his/her property tax deductions capped at $10,000. This would basically mean that most Long Islanders would lose deductions of $10,000 or more." - Heller Tax Grievance

- "In Suffolk County, NY- 97.29% of homes under Current Law where the mortgage interest in the first year of the loan would be high enough for a homeowner to take the MID (Mortgage Interest Deduction) instead of opting for the standard deduction vs 35.76% of homes under Proposed Compromise Bill where the mortgage interest in the first year of the loan would be high enough for a homeowner to take the MID instead of opting for the standard deduction." - Zillow

5. " Families with children... For each child, a family will get a $2,000 tax credit, twice the current rate, and $1,400 would be refundable." - Newsday

6. "The bottom line is the for tax purposes, owning a home would be treated the same as renting one for the great majority of Americans." - NAR

7. "... Commercial real estate owners have reason to cheer. The bill, which includes deep tax cuts for corporations, reduces the tax rate and provides a steep deduction for some businesses structured as partnerships, limited liability companies and other so-called pass through companies..." - Fox Business

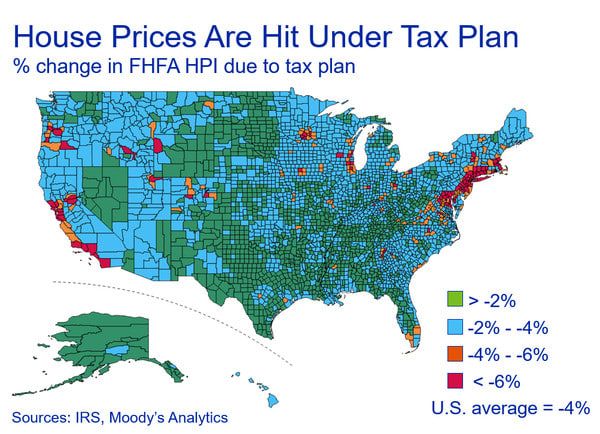

8. ".. Moody's Analytics report... estimates that by the summer of 2019 home prices will be down nationally by 4 percent compared to where they'd be if no tax bill was passed." - Curbed

9. "Interest on second/vacation homes with remain deductible but will also be capped at $750,000." - Zillow